UNH Research Policies

Research Administrators Training Series

Award Life Cycle

- Uniform Guidance Update

- University Policies

- Cost Sharing

- Cost Transfers

What is Uniform Guidance

- Major changes in regulations impacting research administration with heavy emphasis on documentable evidence of compliance

- This guidance compiles eight existing OMB circulars applicable to Educational Institutions, Non-Profit Organizations, and State, Local and Indian Tribal Governments into one document.

- Federal agencies must develop their own agency-specific policies that conform to the Uniform Guidance. Additional changes can occur once those policies are released.

- UNH must ensure compliance with the Uniform Guidance and with agency-specific policies.

Highlights of Key Changes

- Procurement

- Sub-recipient Monitoring

- Materials and Supplies

- Administrative and Clerical

- Other Cost Items

- Cost Share

|

- Facilities & Administrative Rate

- Prior Approvals

- Internal Controls

- Performance Measurement

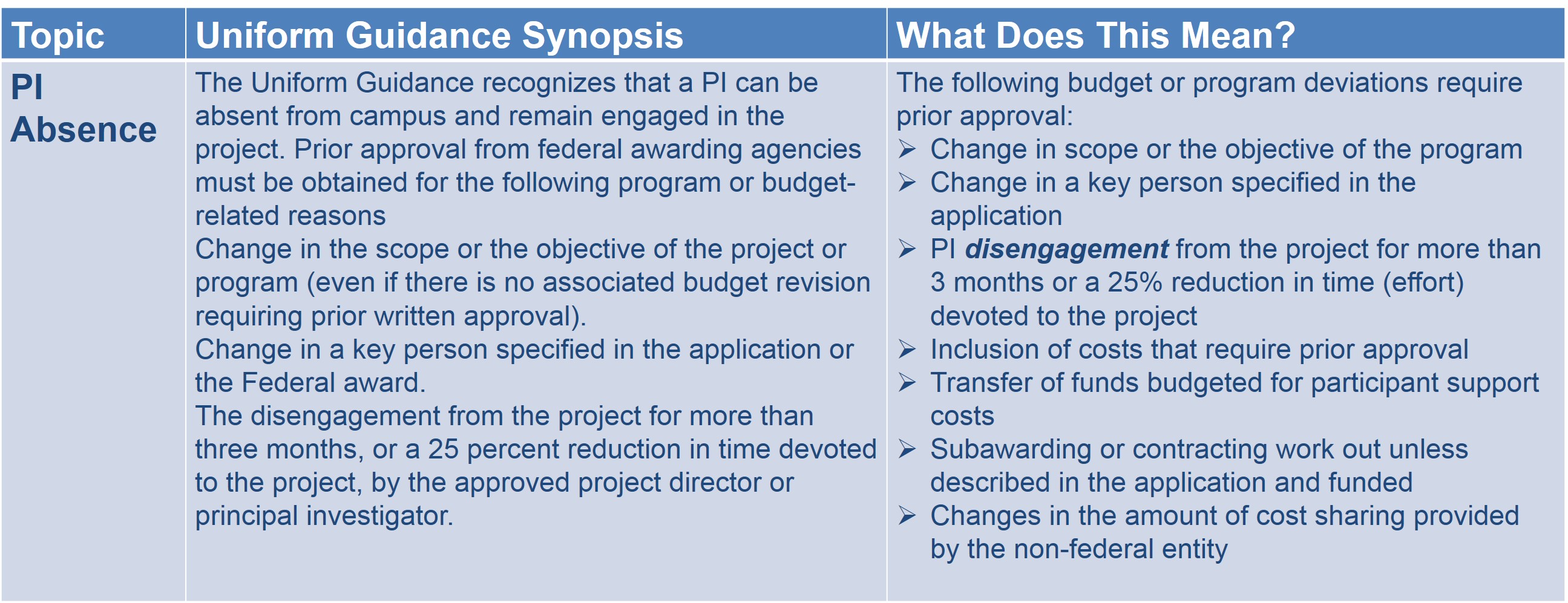

- PI Absence

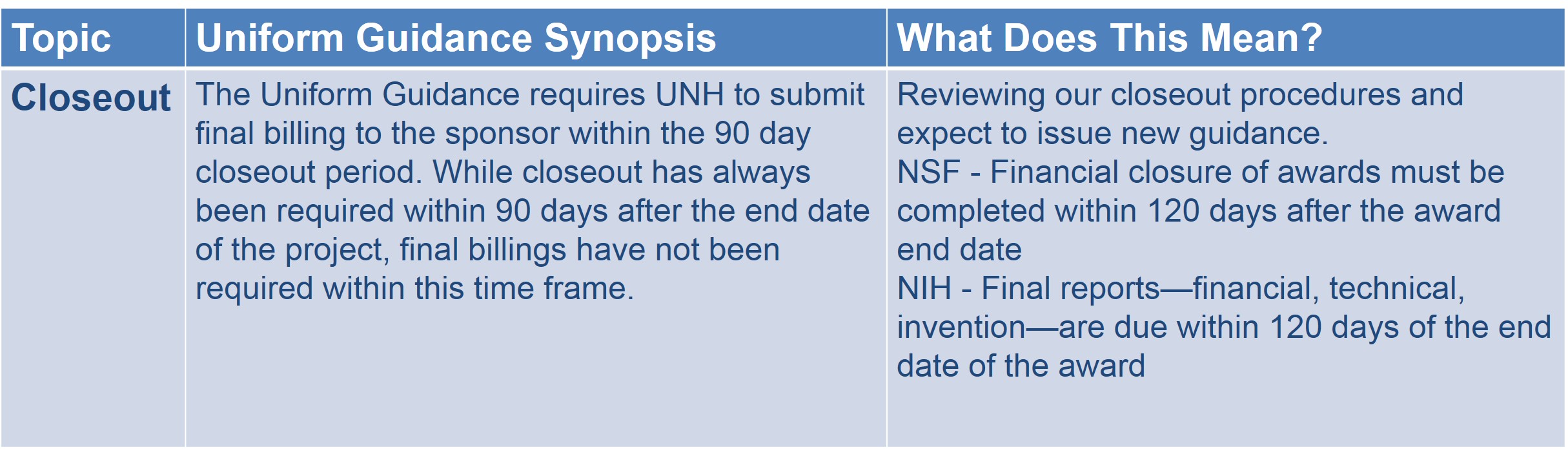

- Closeout

|

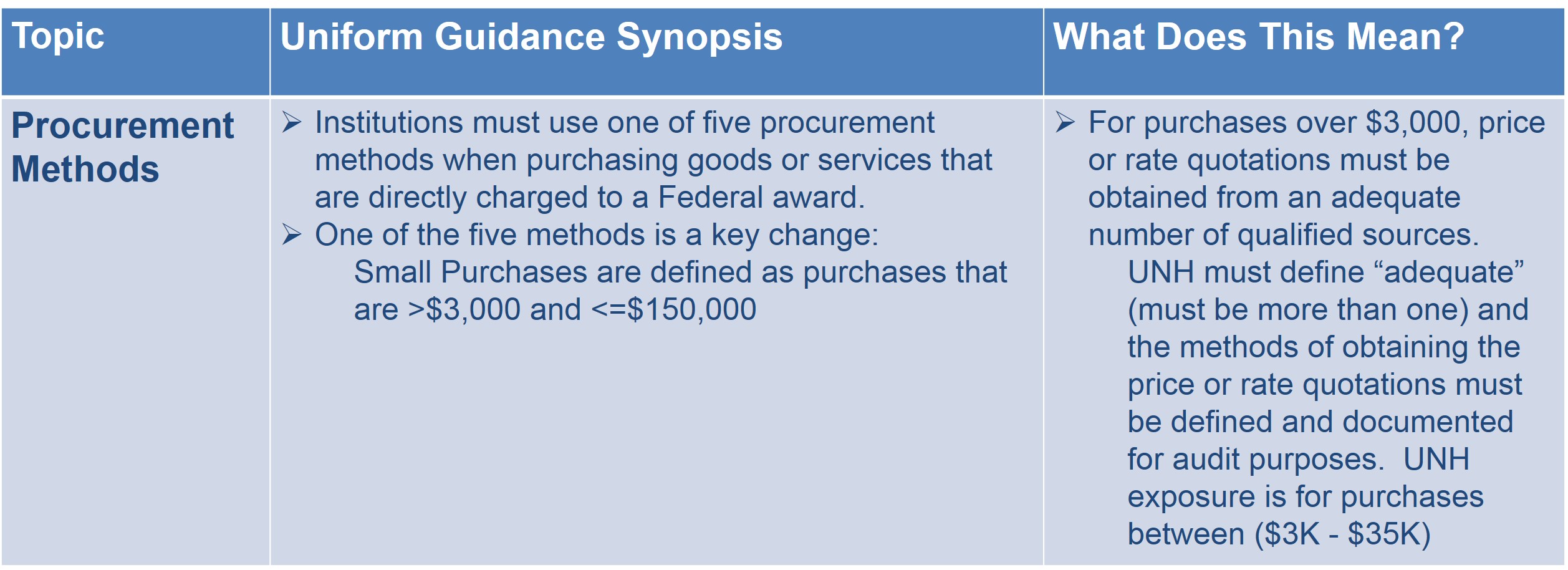

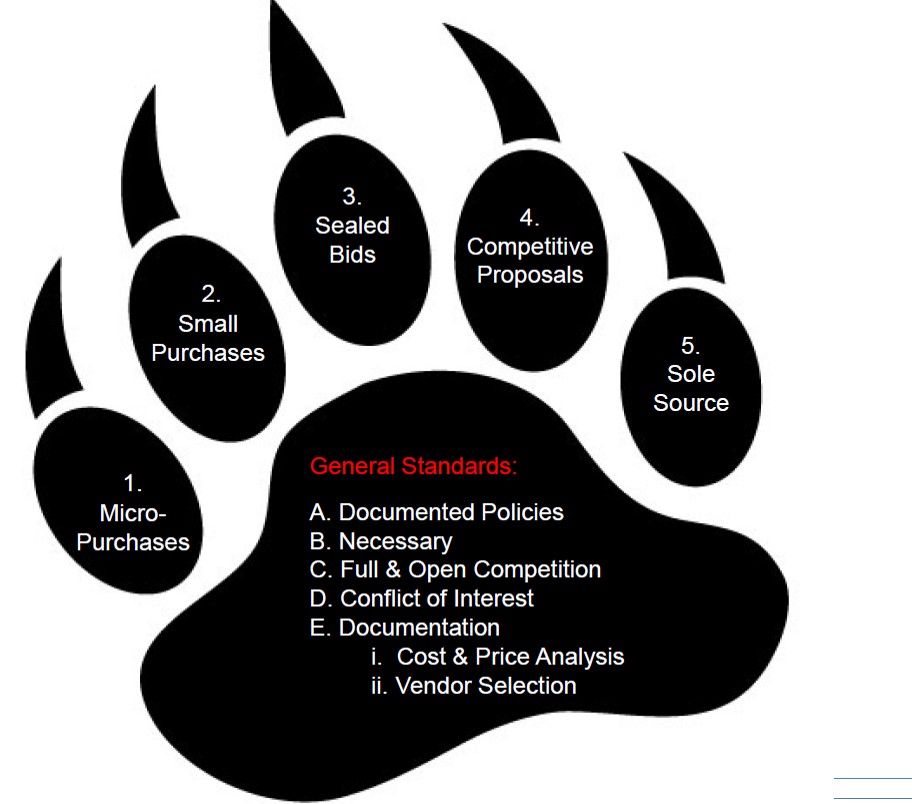

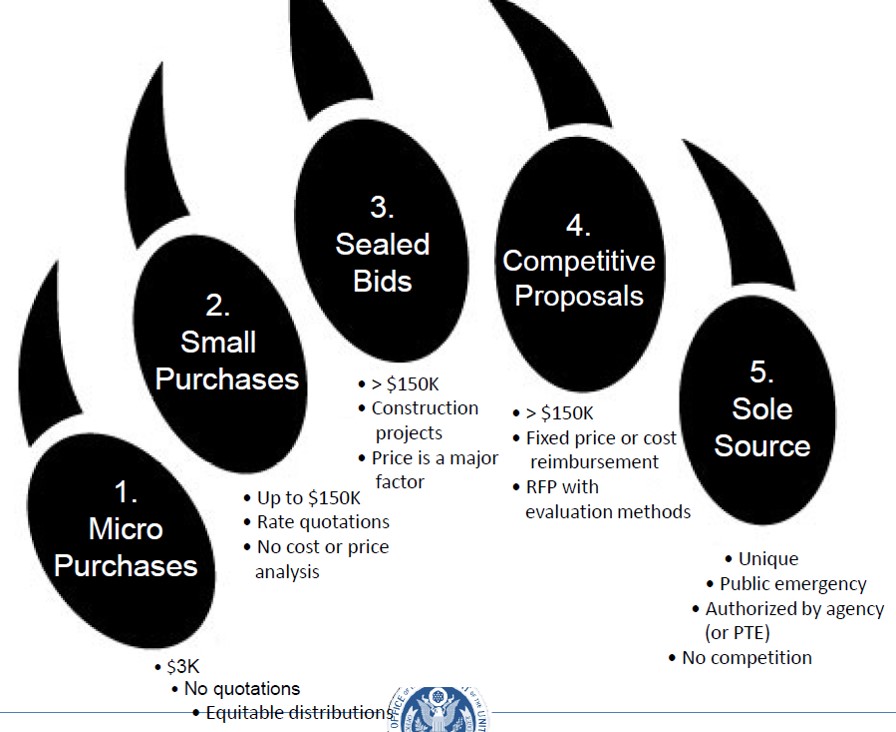

Major Changes in Procurement (200.317 – 200.326)

Major Changes in Procurement (200.317 – 200.326)

Major Changes in Procurement (200.217 – 200.326)

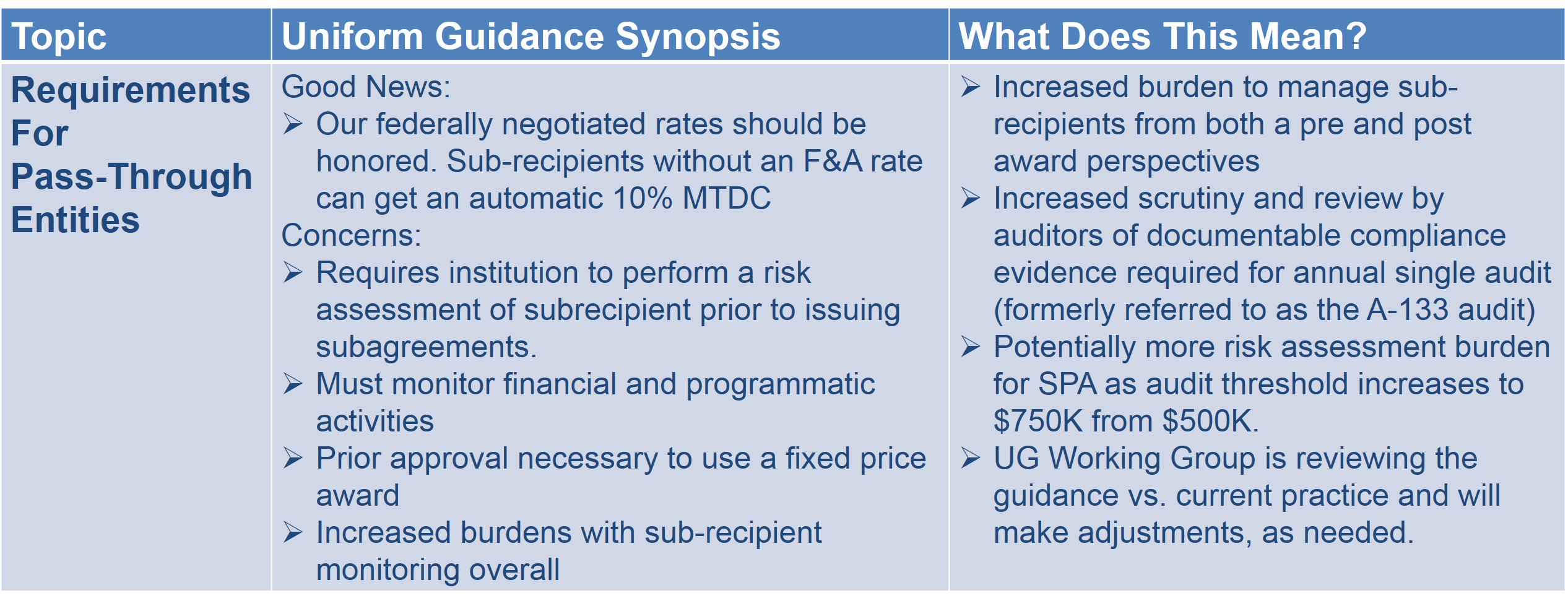

Fixed Price Subawards (200.332)

Pass-Through Entities(200.330 - 332)

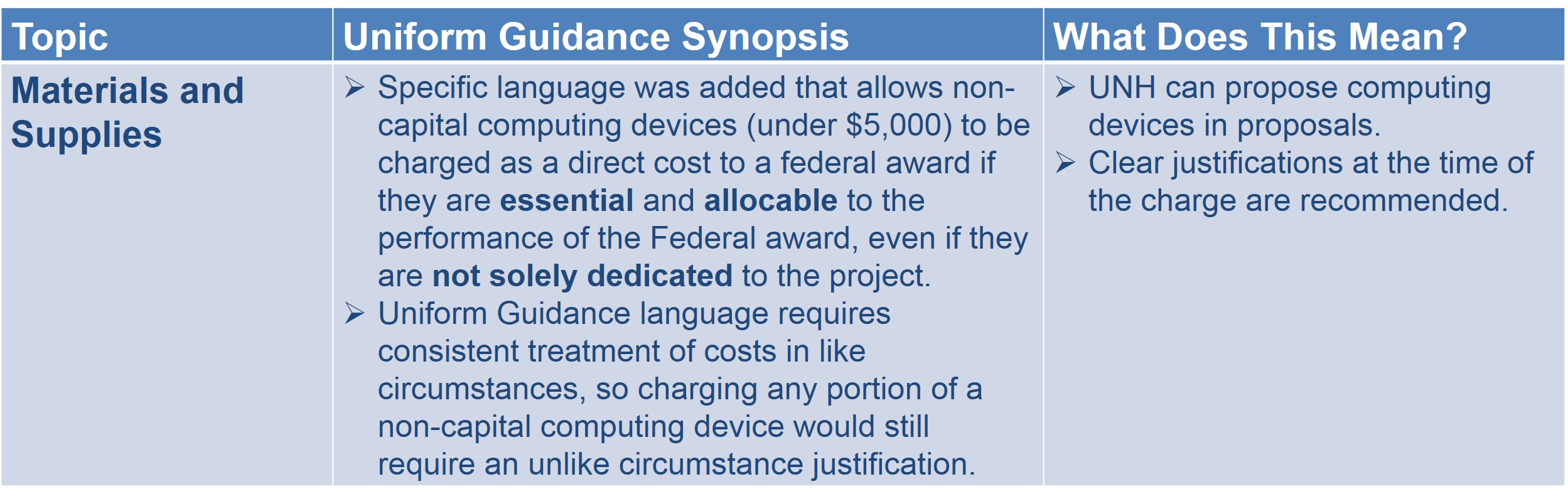

Materials and Supplies (200.453)

- Materials and supplies section now specifically includes “computing devices” as an allowable cost.

Administrative and Clerical (200.413)

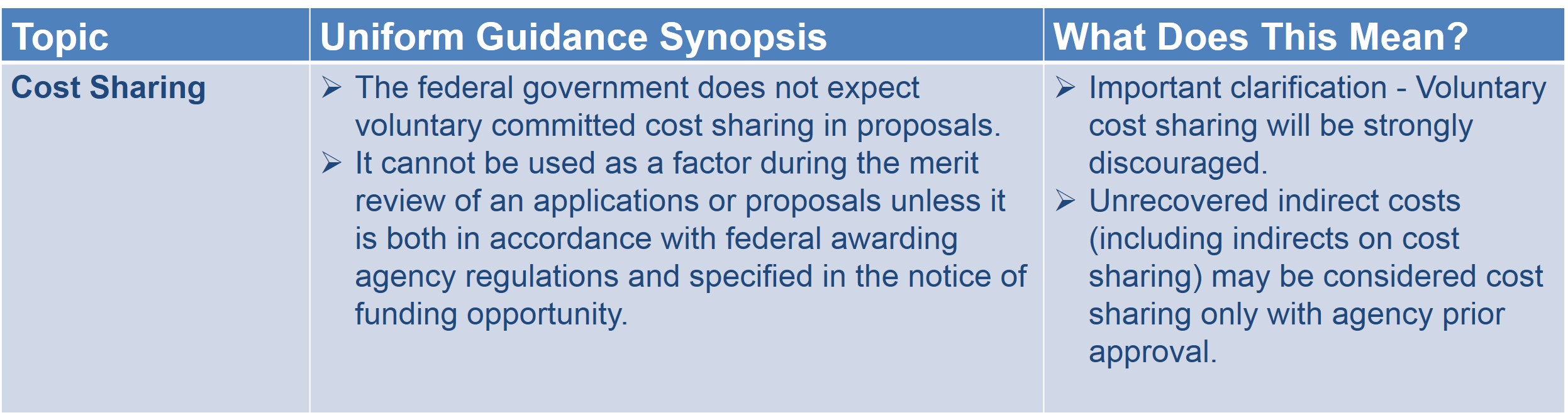

Cost Share (200.306)

- Cost sharing on federal proposals cannot be used as a factor during the merit review of a proposal except in certain circumstances.

Internal Controls (200.303)

- Strong Emphasis on Internal Controls

- Mentioned 103 times in the 12/26/2013 Federal Register notice

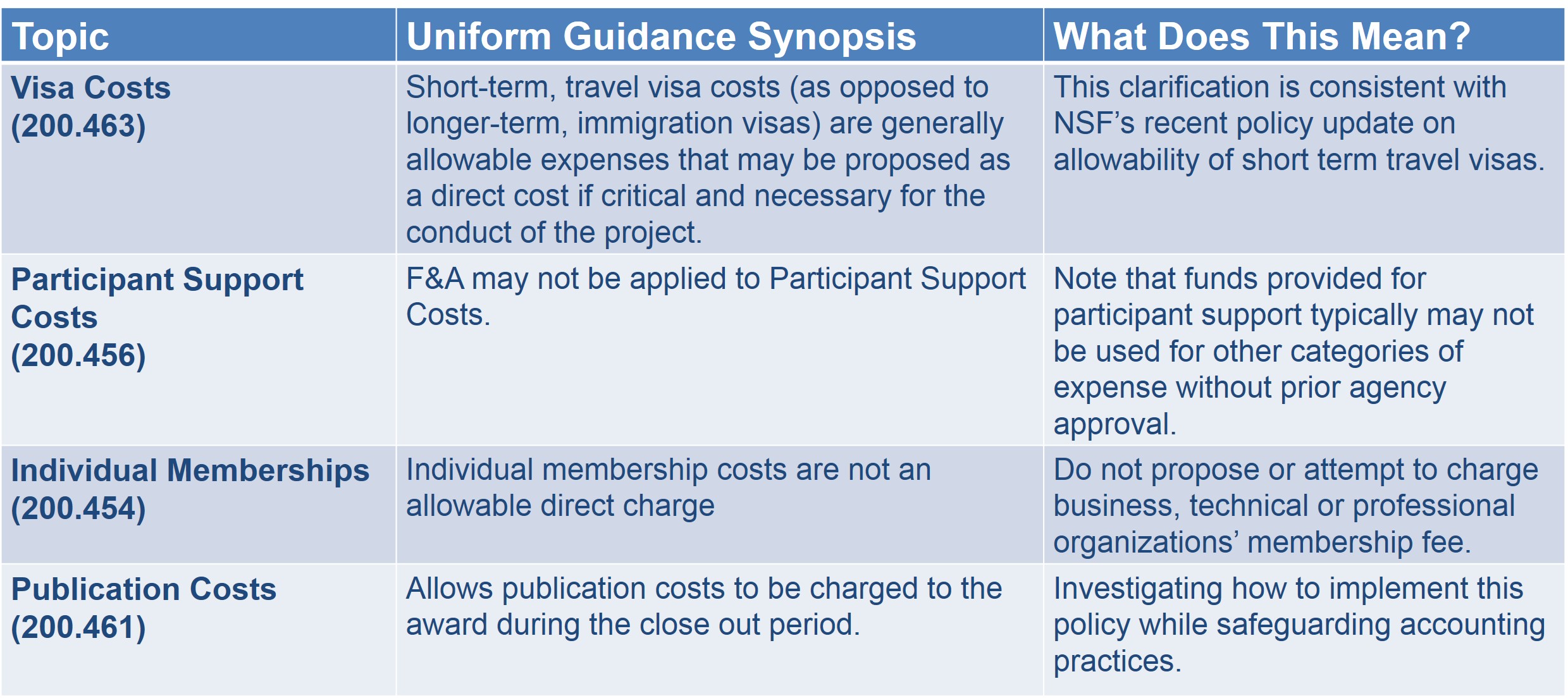

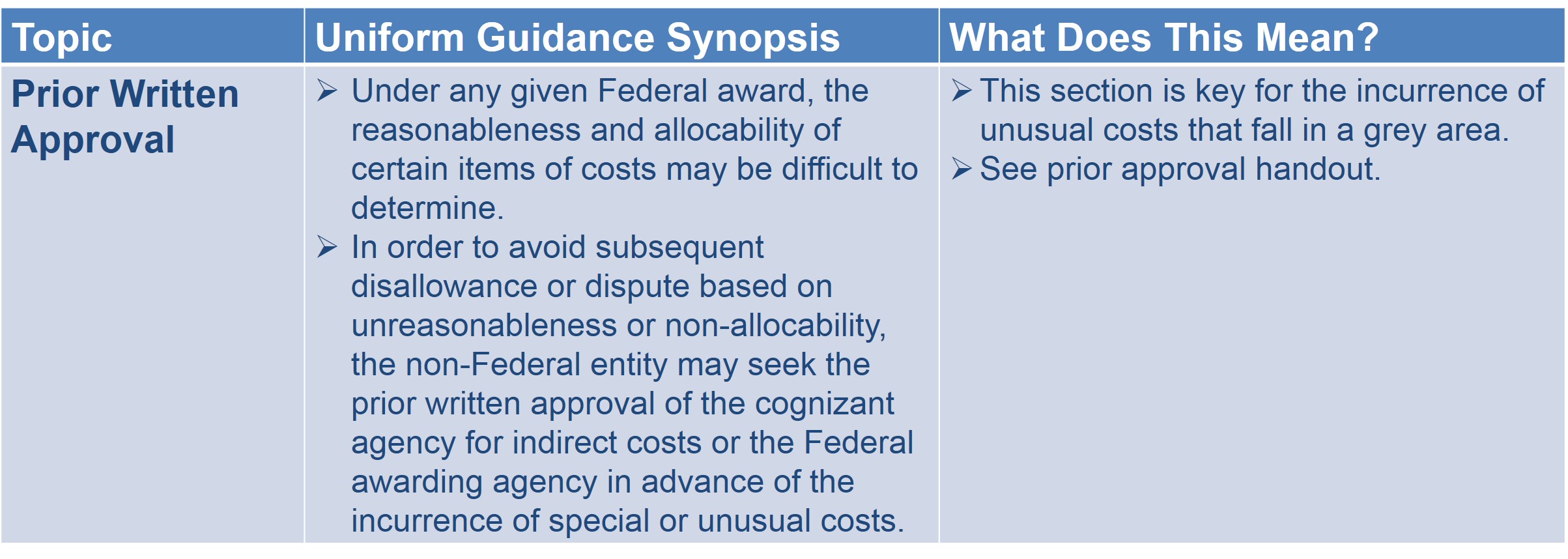

Prior Written Approval (200.407)

- New Section that clarifies when to seek prior approval of the agency.

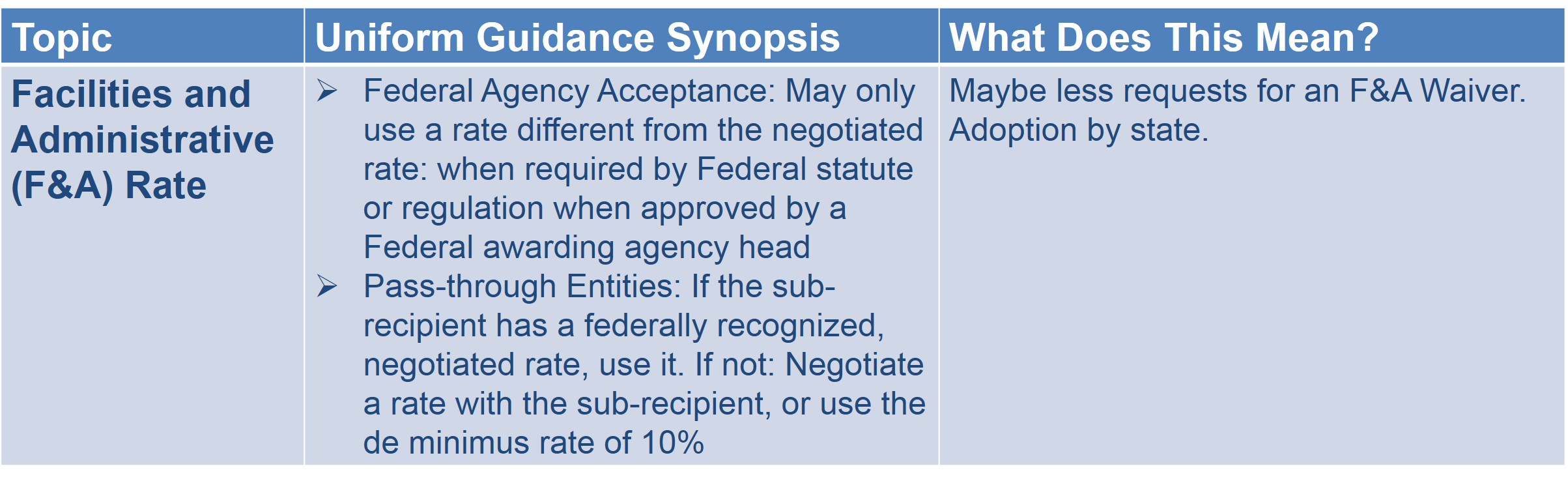

F&A Rate (200.414 and 200.331)

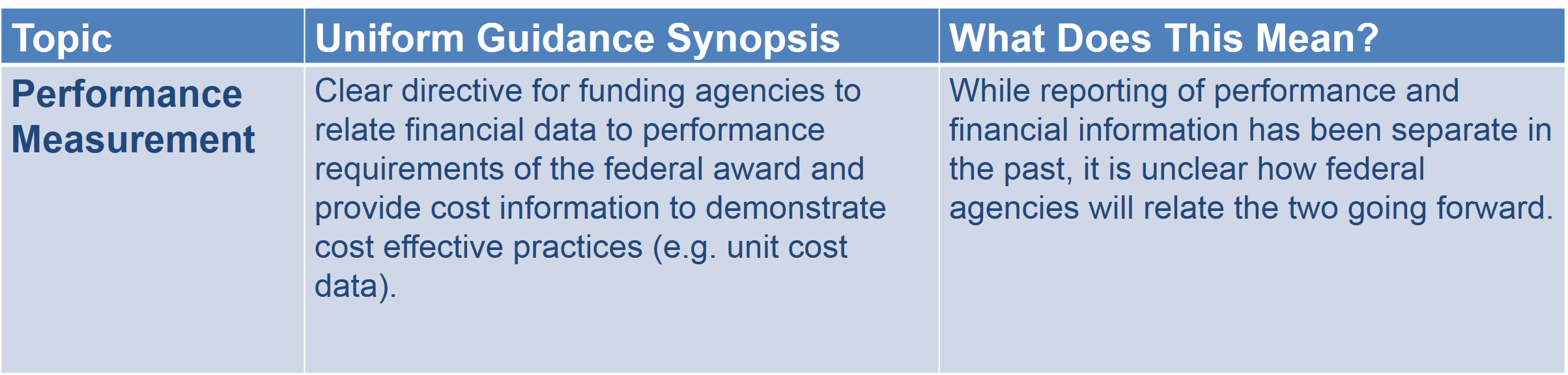

Performance Measurement (200.301)

Revision of Budget & Program Plans (200.308)

University Policies

Cost Sharing

Cost Transfers

Cost Sharing

Uniform Guidance States:

- Under Federal research proposals, voluntary committed cost sharing is not expected.

- Cannot be used as a factor during the merit review of applications or proposals, but may be considered if it is both in accordance with Federal awarding agency regulations and specified in a notice of funding opportunity.

- In addition, the National Science Foundation will not accept proposals with voluntary committed cost sharing unless it is specified in the notice of funding opportunity.

What is Cost Sharing

All contributions, including cash and third party in-kind which meet seven criteria:

- Verifiable

- Not included as contributions for other federally-assisted project or program

- Allowable, allocable, reasonable and necessary for the conduct of the program.

- Not paid by the Federal Government under another award

- Provided for in the approved budget by the awarding agency

- Conforms to other Circular provisions

What is Cost Sharing

- Mandatory Cost Sharing

- Voluntary Cost Sharing

- Not required by the sponsor

- Voluntary Uncommitted Cost Sharing:

- Faculty-donated effort or Other Direct Costs above that agreed to as part of the award

- Committed Cost Sharing

- If cost sharing is committed, that is, proposed by UNH and accepted by the sponsor, then it must be accounted for as cost sharing.

- Uncommitted effort does not need to be tracked.

Cost Sharing

Implicit in the University’s commitment to cost share is the PIs agreement to ensure that:

- voluntary cost sharing is permitted by the particular sponsor and project for which it is being proposed

- funds are available for cost shared direct costs once awarded

- cost shared expenses will be appropriately charged, tracked, and accounted for in compliance with University and sponsor requirement

- the PI will certify these expenditures in the same manner as all sponsored project spending

Note: The tracking, reporting and certifying of cost sharing are subject to audit.

Cautions

- Beware of expressions of support in budget narratives and scope of work that are not included in budget figures.

- Remember that all direct cost sharing has a respective F&A component.

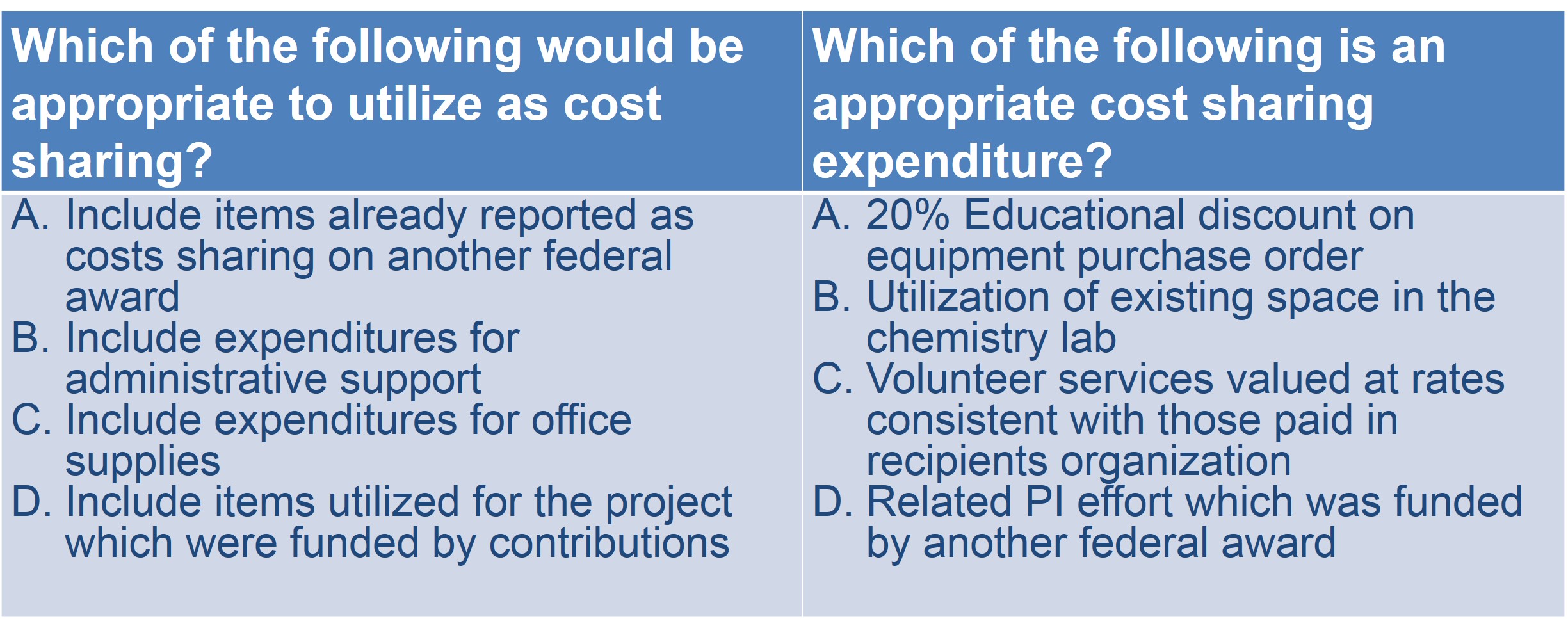

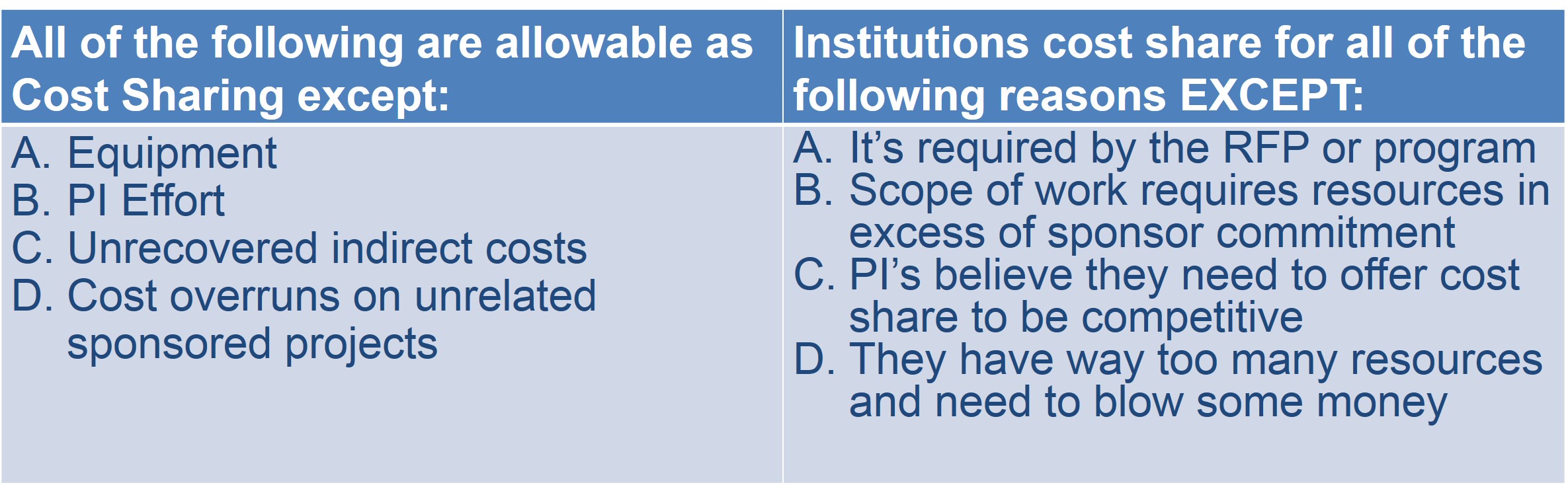

What is allowable?

- Gifts or Endowed Funds

- Yes, gifts or endowed funds may be used for cost share.

- Equipment

- Yes, if newly purchased, specifically for project

- Yes, donated property from third parties as long as assessment does not exceed fair market value of the property at time of donation.

- previously owned equipment may not be offered as matching

What is allowable?

- Space and Facilities

- No, space and facilities typically serve joint objectives and their cost is factored into the F&A rate

- Yes, if space is rented from a third party to perform a project.

- Unrecovered Indirect Costs, including indirect costs on cost sharing

- Yes, with the prior approval of the Federal Awarding Agency

What is allowable?

- Retired/Emeritus Faculty

- Yes, if the retired/emeritus faculty’s member’s effort is “integral and necessary” to the project.

- Effort would be considered as Volunteer Services.

- Some form of reasonable documentation would need to be maintained to validate the actual hours worked.

- Cost Overruns

- Yes, overruns may meet the cost sharing requirements on the project for which they are incurred.

- It is unallowable for the cost overruns on one project to be used as cost sharing on another

Cost Transfers

Definition

An after-the-fact reallocation of actual costs to or from a federal or non-federal sponsored program (grant, including cost share and program income, or contract) after the initial expense has been posted.

Policy

- Cost transfers may be initiated by BCS staff to correct an obvious error

- At the direction of the PI/PD or his/her designee

- Cost transfers initiated less than 90 days after the end of the monthly accounting period of the original transaction posting are subject to after-the-fact review by SPA

- Pre-approvals from SPA are required:

- Transfers are more than 90 days after original posting

- Transfer of an expense previously transferred to a sponsored program

- Unallowable Cost Transfers:

- Transfers of expenses near the end of award to consume funds

- To remove a deficit

Criteria for Cost Transfers

- In conformance with Institute and sponsor policies

- is it allowable, allocable, reasonable, and consistent?

- Timely

- Cost transfers should be prepared and submitted as soon as the need for a transfer is identified, but no later than 90 days after the posting is made and/or within 30 days of the project end date, whichever comes first

- Cost transfers exceeding this time frame will require additional documentation as to why the transfer request was not made on a timely basis

Criteria for Cost Transfers

- Fully Documented

- Cost transfers must contain a justification that clearly shows:

- Benefit to the receiving project

- Allowability and allocability to the new sponsored project

- Reason for transfer

- Systemic causes are corrected so they will not recur

- The reason for any delay in the timely processing of the transfer if the transfer date exceeds the recommended time frame

- It was reviewed by a knowledgeable person such as the PI

Criteria for Cost Transfers

- A good justification will allow anyone reviewing the cost transfer to understand how the expense benefits the receiving sponsored project.

- It should answer: who, what, where, when, and why? It should be easily understood by anyone reviewing the journal voucher (think: “If I leave, will an auditor be able to understand this two years from now?”). It may include documentation to support the justification. Some examples of documentation are:

- Allocation methodology

- An invoice or packing slip

- Notes on an expenditure statement, “per PI …”

- Supported by appropriate approvals

Examples

- The length of a justification is irrelevant.

- A justification must include the pertinent facts, be succinct, and be easily understood by anyone who may read it now and in the future.

- Inadequate

- “To allocate chemicals from department discretionary account to the grant.”

- The inadequate justification does not address the questions of whether or not the chemical charges are allowable and allocable to the grant to which they are being charged through the cost transfer.

Examples

- Adequate

- “Department X used a department discretionary account to collect all department chemical charges. All charges to sponsored projects were proposed and approved consistent with UNH and sponsor policy and included in the proposal budget. Documentation, including allocation methodology, is in departmental files.”

- The adequate justification states that the department is aware of the documentation requirements for these charges, attests that all requirements have been met, and states where the documentation records may be found.

Examples

Does this journal voucher explanation provide adequate justification?

- Laboratory A purchased $600 in laboratory supplies in August. They processed a journal voucher the following October for the supplies, stating in the remarks that “per a conversation with the PI, it was determined that these expenses were charged to an old cost object in error. This journal entry is to transfer that expense to the correct project.”

Examples

Would you accept this as adequate justification?

- Did they state the original error?

- Is the expense allocable to the new grant

- Was the transaction documented and processed in accordance with best practices?

Examples

This journal entry would not be accepted as adequate documentation for this transfer for the following reason:

- Based on the information provided, it is unclear how to evaluate the appropriateness of the transaction. (How did the PI know that those supplies benefited the other project? Did he or she review an expenditure statement or a project budget?) Why is it important to have timely, well-documented, and carefully justified cost transfers?

- Any time a transfer is initiated, the assumption is that the transaction was not handled properly initially. If expenses are being transferred to another grant, there will be considerable scrutiny of the reasons for the transfer and of the justification for moving those charges.

Examples

- Frequent and poorly documented cost transfers may indicate problems in the management of research.

- Federal auditors more closely scrutinize the allowability, allocability, and reasonableness of cost transfers.

- Federal research sponsors are giving increased attention to the reason behind cost transfers from and to sponsored projects.

Summary

When preparing a journal voucher to transfer an expense, review the transaction and the documentation provided to support it. Have you clearly shown that:

- The expense directly benefits the receiving project

- The expense is allowable on the receiving project

- There are no restrictions which preclude this transfer (e.g., restrictions on travel or equipment)

- The transaction meets all sponsor requirements

- The transfer complies with all UNH policies

- The reason for the expense being charged incorrectly to the initial project

- The reasons for any delay in a timely processing of the transfer

- Any systemic problems that might cause this problem to be repeated have been addressed

Thank you.

Questions?

Next Session:

When: March 17th

- Session I 9:00-10:15 am

- Session II 10:30-11:45 am

Where: MUB Room 338/340

What: Working Together

Knowledgeable research administrators are essential to the management of the research enterprise and play a critical role in research administration at the University.